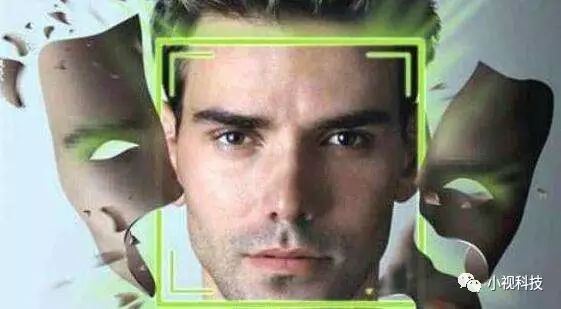

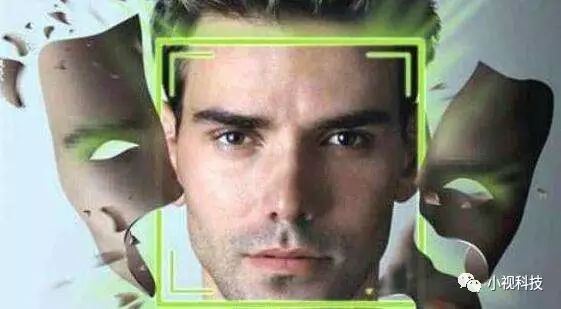

At this year's 315 party, CCTV pointed out a security vulnerability in facial recognition in mobile applications: processed social platform photos can be verified through live banking apps, achieving facial login. The cracked facial recognition technology poses dual risks for both users and platforms. Since 2014, Minivision Technology has been committed to enhancing the security of facial recognition in different application scenarios and improving user experience. In the "Live 2.0" version of Minivision Technology, a new live technology is adopted, which distinguishes between the reflective imaging of real faces in front of the camera and the reflective imaging of synthetic images, distinguishing whether the camera is facing real users or malicious attacks, in order to respond to similar fake face attacks that occurred in the 315 evening party.

What caused the fake face attack at the 315 party?

In the 315 evening party of CCTV, the host used a single static image to verify on the app. The app locks in information such as the position and texture of facial features, and uses image processing methods such as affine transformation to project these textures onto an emoticon template (such as varying degrees of eye closure, smile, etc.), successfully passing some app validations. This is a fatal weakness in traditional living algorithms - relying on the cooperation of the actors to make actions to ensure that the other person is a real person, but cannot prevent attacks from synthetic images. At present, many technologies can already synthesize different facial movements of a person based on a single facial image, and similar sequences can also be synthesized based on the new deep learning image generation technology, which poses numerous risks to traditional living technology.

Minivision Technology "Living 2.0" uses light to defend against fake face attacks

In fact, there is a significant difference in the light reflected by images displayed on screens or projection screens compared to the light reflected by faces. Minivision Technology's new live technology, "Live 2.0," is based on deep learning and has been trained with massive data of millions of images and videos. It has been found that the real face is reflected and imaged when data is collected in front of the camera, which is completely different from the images displayed on the screen, printed photos, and 3D printed objects. Neural networks based on massive data can capture these differences in video sequences to determine whether the object is a real person or a forged malicious attack.

A large amount of test data shows that Xiaoshi Technology's "Live 2.0" can effectively prevent attacks such as synthesized videos, screen images, and physical photos. Its accuracy and attack resistance greatly surpass traditional living organisms. By simply inputting the collected real-time facial video stream, "Live 2.0" can automatically implant the live detection algorithm into the video stream without being detected by the user and without action coordination. It seems like it was just a recognition, but in reality, it has already triggered a live organism.

Take multiple measures to ensure financial security

In order to meet the needs of customers for live detection in different scenarios, Minivision Technology has implanted the SDK of "Live 2.0" into Android, IOS, WeChat official account, WeChat applet and other platforms. This is also one of the first artificial intelligence technology companies in the industry to implant live technology on multiple platforms.

Face recognition is only one link in the multiple protections of the financial industry. Minivision Technology provides risk early warning, credit history assessment A series of services such as intelligent investment advisory utilize multiple means to reduce financial risks and safeguard financial security.